how much taxes does illinois take out of paycheck

How much taxes is taken out of a paycheck in Illinois. Employees who file for.

Tax Withholding For Pensions And Social Security Sensible Money

Estates over that amount must file an Illinois.

. You have paid at least 1000 in employee earnings due to domestic work in a calendar quarter. You would be taxed 10 percentor 900 which averages out to 1731 out of each weekly paycheck. How much is 75k after.

For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in a given calendar year. The Illinois Paycheck Calculator is designed to help you understand your financial situation and determine what you owe in taxes. The telecommunications tax is a tax on services including home phone lines cell phones television service and internet.

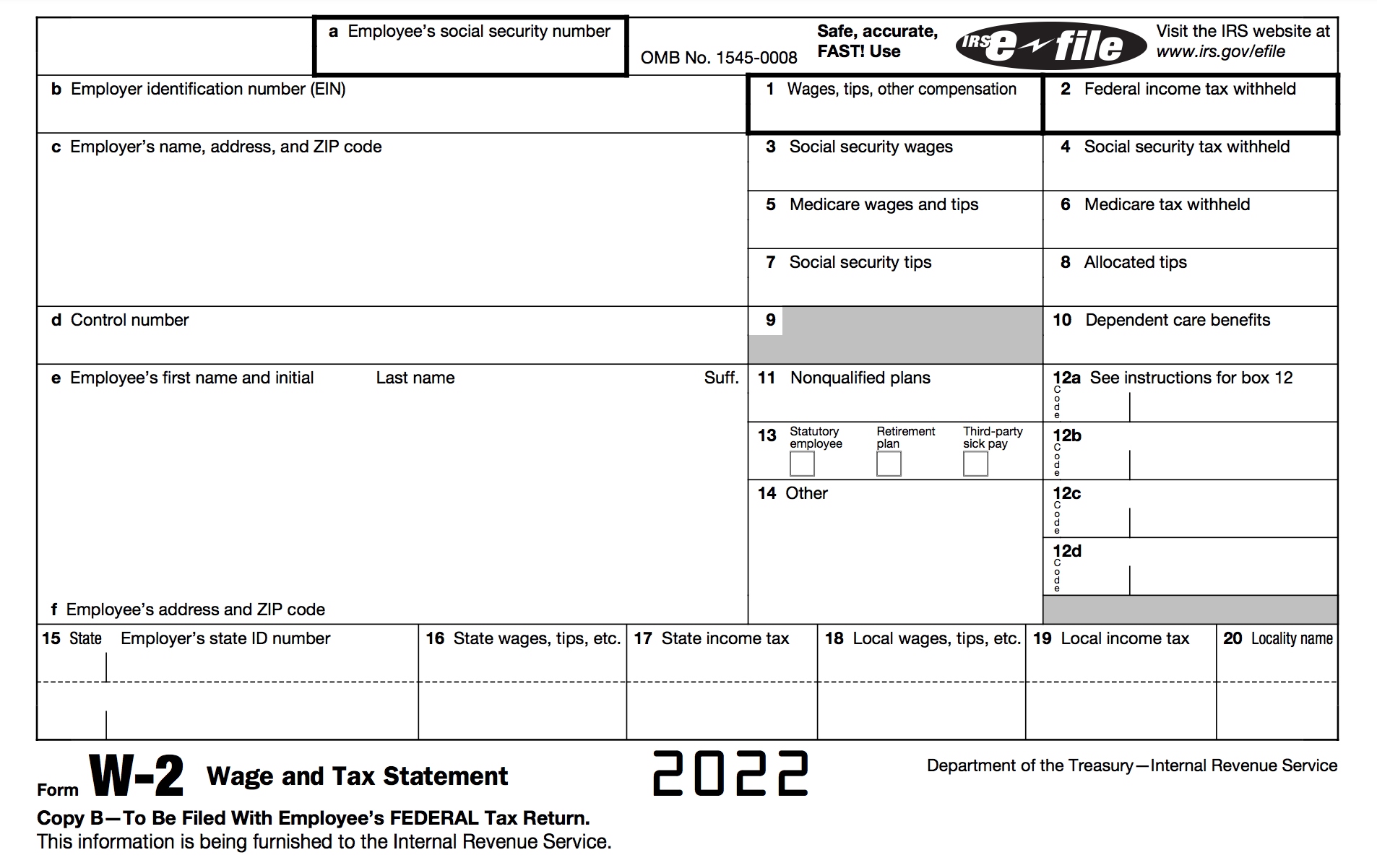

Amount taken out of an average biweekly paycheck. Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Illinois Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. The Illinois Paycheck Calculator uses Illinois. It varies by location.

As of January 1 2022 the Illinois unemployment tax rate ranges from 0725 to 7625. Total income taxes paid. According to the Illinois Department of Revenue all incomes are created equal.

27 rows Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both. Illinois Telecommunications Tax. Illinois tax year starts from july 01 the year before to june 30 the current year.

Figure out your filing status. The federal withholding tax has seven rates for 2021. This Illinois hourly paycheck.

10 12 22 24 32 35 and 37. How Much Federal Tax Is Taken Out Of My Paycheck In Illinois. Employers in Illinois must deduct 145 percent from each employees paycheck.

Employers must match this tax. The federal withholding tax rate an employee owes depends on their income. 495Everyones income in Illinois is taxes at the same rate due to the states flat income tax system of 495.

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either. Amount taken out of an average biweekly. Unlike Social Security all earnings are subject to Medicare taxes.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Personal income tax in Illinois is a flat 495 for 2022. How Much Taxes Is Taken Out Of A Paycheck In Illinois.

Employers are responsible for deducting a flat income tax rate of 495 for all employees. Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy. How much taxes do they take out of a 900 dollar check.

Work out your adjusted gross income.

Illinois Local Tax Changes For Out Of State Remote Sellers

Illinois Payroll Services And Regulations Gusto Resources

What Are Employer Taxes And Employee Taxes Gusto

Millions Of Americans Could Be Stunned As Their Tax Refunds Shrink The Washington Post

:max_bytes(150000):strip_icc()/GettyImages-646424806-1278847b0c7748b5833c3245cd82b287.jpeg)

Illinois Income Tax Agreement With Bordering States

Court Says Illinois Needs Budget To Make Full Payroll Bond Buyer

How Many Tax Allowances Should I Claim Community Tax

Here S How Much Money You Take Home From A 75 000 Salary

What Taxes Are Taken Out Of A Paycheck In Illinois

Referenda Archives Taxpayers United Of America

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Illinois Estate Tax Everything You Need To Know Smartasset

What Taxes Are Taken Out Of A Paycheck In Illinois

Paycheck Calculator Free Payroll Tax Calculator Online Payroll Software

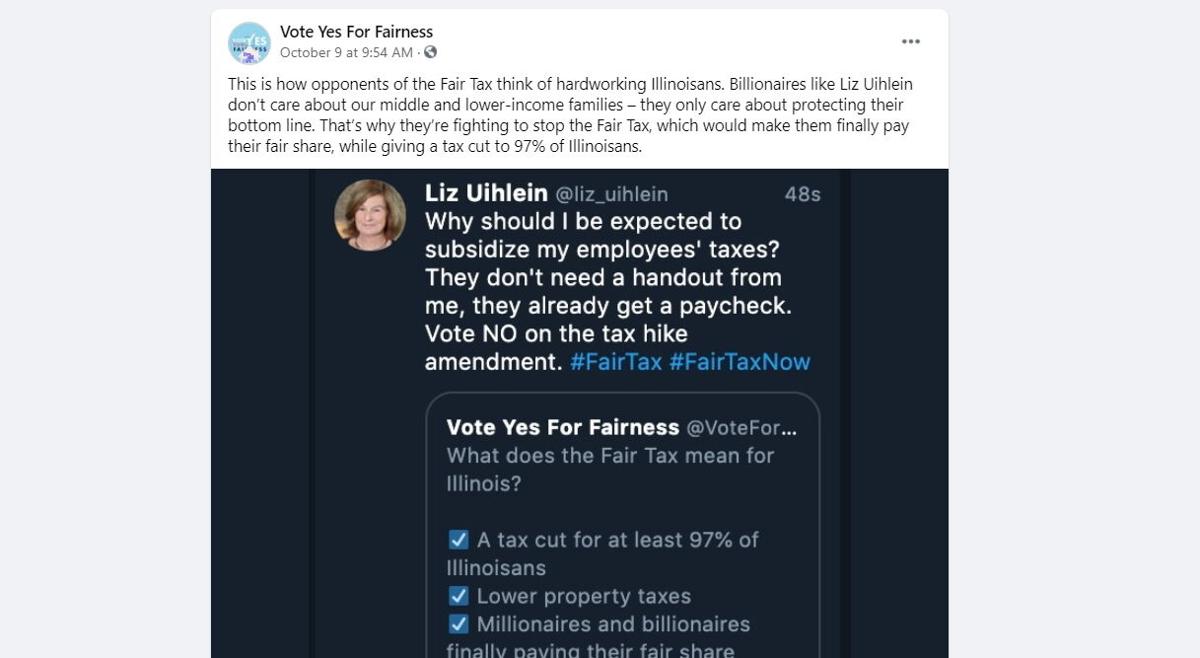

Vote Yes For Fairness This Is How Opponents Of The Fair Tax Think Of Hardworking Illinoisans Billionaires Like Liz Uihlein Don T Care About Our Middle And Lower Income Families They Only

Pay Stub Requirements By State Overview Chart Infographic

Illinois Paycheck Calculator Smartasset